Money market accounts are offering attractive yields, with the top rate currently standing at 4.41% APY, presenting a compelling option for savers looking to maximize returns on their cash holdings. This elevated rate reflects the broader interest rate environment and provides a significant opportunity for individuals to earn more on their savings compared to traditional savings accounts or checking accounts.

Money Market Mania: Earn 4.41% APY Today!

In today’s financial landscape, money market accounts (MMAs) have emerged as a popular choice for individuals seeking a safe and liquid way to grow their savings. With the highest annual percentage yield (APY) now reaching 4.41%, these accounts offer a competitive alternative to traditional savings accounts and other low-yield investment options. This article delves into the details of money market accounts, their benefits, and how to make the most of these high-yield opportunities.

Understanding Money Market Accounts

A money market account is a type of savings account offered by banks and credit unions. Unlike traditional savings accounts, MMAs typically offer higher interest rates, making them attractive to savers looking to maximize their returns while maintaining easy access to their funds. These accounts are often insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA), providing a level of security for depositors.

“Money market accounts offer a blend of higher yields and liquidity, making them a suitable option for those seeking to grow their savings without locking up their funds for an extended period,” explains a financial analyst.

Key Features of Money Market Accounts:

- Higher Interest Rates: MMAs generally offer higher interest rates than traditional savings accounts. The exact APY varies depending on the financial institution, the account balance, and the prevailing economic conditions.

- FDIC or NCUA Insurance: Money market accounts are typically insured up to \$250,000 per depositor, per insured bank, or credit union, providing a safe haven for savings.

- Liquidity: MMAs allow depositors to access their funds relatively easily. While there may be some restrictions on the number of transactions per month, the funds are generally accessible when needed.

- Minimum Balance Requirements: Some MMAs require a minimum balance to open the account or to earn the advertised APY.

- Tiered Interest Rates: Many MMAs offer tiered interest rates, meaning the APY increases as the account balance grows.

Why the Surge in Money Market Account Rates?

The current high-interest rate environment is a key factor driving the attractive yields offered by money market accounts. As the Federal Reserve has raised interest rates to combat inflation, banks and credit unions have responded by increasing the rates they offer on deposit accounts, including MMAs. This allows them to attract and retain deposits in a competitive market.

“The Federal Reserve’s monetary policy plays a significant role in determining the interest rates offered on money market accounts,” notes an economist. “When the Fed raises rates, banks typically follow suit to attract deposits.”

Who Should Consider a Money Market Account?

Money market accounts are suitable for a variety of savers, including:

- Individuals with short-term savings goals: Those saving for a down payment on a house, a vacation, or other short-term goals can benefit from the higher yields offered by MMAs.

- Retirees: Retirees looking for a safe and liquid place to park their savings can use MMAs to generate income while preserving their principal.

- Emergency fund savers: MMAs provide a secure and accessible place to keep an emergency fund, ensuring the funds are available when needed while earning a competitive interest rate.

- Conservative investors: Individuals who are risk-averse and prefer to avoid the volatility of the stock market may find MMAs to be a suitable option for their savings.

How to Choose the Right Money Market Account

When selecting a money market account, it’s important to consider the following factors:

- APY: Compare the APYs offered by different banks and credit unions to find the highest possible rate.

- Minimum Balance Requirements: Check the minimum balance requirements and ensure you can meet them to earn the advertised APY.

- Fees: Be aware of any fees associated with the account, such as monthly maintenance fees or transaction fees.

- FDIC or NCUA Insurance: Verify that the account is insured by the FDIC or NCUA to protect your deposits.

- Accessibility: Consider the accessibility of the funds and any restrictions on withdrawals or transfers.

- Reputation of the Financial Institution: Research the reputation and financial stability of the bank or credit union offering the account.

- Online and Mobile Banking: If you prefer to manage your accounts online, ensure the financial institution offers convenient online and mobile banking services.

Maximizing Your Returns with Money Market Accounts

To maximize your returns with money market accounts, consider the following strategies:

- Shop around for the best rates: Compare rates from multiple banks and credit unions to find the highest APY.

- Maintain a high balance: Many MMAs offer tiered interest rates, so maintaining a higher balance can help you earn a higher APY.

- Reinvest your earnings: Reinvest the interest earned on your MMA to take advantage of the power of compounding.

- Consider opening multiple accounts: If you have a large sum of money to save, consider opening multiple MMAs at different financial institutions to maximize your FDIC or NCUA insurance coverage.

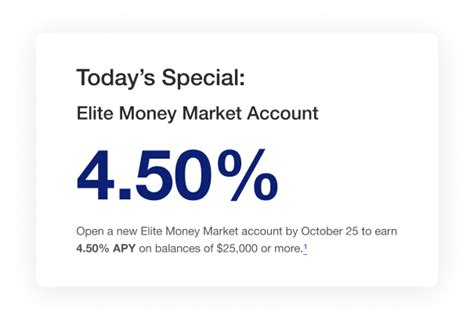

- Take advantage of promotional offers: Some banks and credit unions offer promotional rates or bonuses for opening new MMAs.

The Role of Money Market Accounts in a Diversified Portfolio

Money market accounts can play an important role in a diversified investment portfolio. They provide a safe and liquid place to store cash, which can be used for short-term goals, emergency expenses, or to rebalance a portfolio during market downturns.

“Money market accounts should be viewed as a complement to other investments, such as stocks and bonds,” advises a financial planner. “They provide a safe haven for cash and can help reduce overall portfolio risk.”

Potential Risks and Considerations

While money market accounts are generally considered safe, there are a few potential risks and considerations to keep in mind:

- Inflation Risk: If the inflation rate exceeds the APY earned on the MMA, the purchasing power of the savings may erode over time.

- Interest Rate Risk: If interest rates rise, the APY on the MMA may not keep pace, leading to a lower relative return compared to other investment options.

- Minimum Balance Requirements: Failing to meet the minimum balance requirements may result in a lower APY or account fees.

- Transaction Limits: Some MMAs may limit the number of transactions per month, which could be inconvenient for some depositors.

The Future of Money Market Account Rates

The future of money market account rates will depend largely on the Federal Reserve’s monetary policy and the overall economic outlook. If the Fed continues to raise interest rates to combat inflation, MMA rates are likely to remain elevated. However, if the Fed begins to lower rates, MMA rates may decline.

“The trajectory of money market account rates is closely tied to the Federal Reserve’s actions,” explains an economist. “Savers should monitor the Fed’s policy announcements to anticipate potential changes in MMA rates.”

Alternatives to Money Market Accounts

While money market accounts offer attractive yields, there are other savings and investment options to consider, including:

- High-Yield Savings Accounts: These accounts offer similar features to MMAs but may have lower minimum balance requirements.

- Certificates of Deposit (CDs): CDs offer fixed interest rates for a specific term, providing more certainty about returns.

- Treasury Bills: These short-term debt securities issued by the U.S. government are considered very safe and offer competitive yields.

- Money Market Funds: These mutual funds invest in short-term debt securities and offer the potential for higher returns than MMAs, but they are not FDIC-insured.

- Brokerage Accounts: These accounts allow investors to buy and sell stocks, bonds, and other securities, offering the potential for higher returns but also higher risk.

Conclusion

Money market accounts offering a 4.41% APY represent an attractive opportunity for savers seeking to maximize their returns while maintaining safety and liquidity. By understanding the features, benefits, and potential risks of MMAs, individuals can make informed decisions about how to best utilize these accounts to achieve their financial goals. As the interest rate environment evolves, it’s crucial to stay informed and adapt savings strategies to take advantage of the best available opportunities.

Frequently Asked Questions (FAQ)

-

What exactly is a money market account (MMA)?

A money market account is a type of savings account offered by banks and credit unions that typically pays a higher interest rate than a traditional savings account. It offers a blend of safety, liquidity, and competitive returns, making it a popular choice for savers looking to grow their money without significant risk. These accounts are generally insured by the FDIC or NCUA, providing an added layer of security.

Source: Personal finance articles and banking resources.

-

How does the 4.41% APY on money market accounts compare to other savings options?

The 4.41% APY is significantly higher than the average interest rate offered by traditional savings accounts, which often hovers around 0.01% to 0.50%. It’s also competitive with high-yield savings accounts and short-term certificates of deposit (CDs). However, the specific APY can vary between financial institutions and may be subject to change based on market conditions. Compared to options like stocks or bonds, MMAs prioritize safety and liquidity over potentially higher but riskier returns.

Source: Comparison of current interest rates across various savings products.

-

Are there any risks associated with keeping my money in a money market account?

While money market accounts are generally considered safe, there are a few potential risks to consider:

- Inflation Risk: If the inflation rate exceeds the APY earned on the MMA, the real value (purchasing power) of your savings may decrease over time.

- Interest Rate Risk: If interest rates rise, the APY on your existing MMA may not increase as quickly, leading to a lower relative return compared to newer accounts or other investment options.

- Minimum Balance Requirements: Some MMAs require a minimum balance to earn the advertised APY or avoid fees.

- Transaction Limits: Some MMAs may limit the number of withdrawals or transfers you can make per month.

Source: Financial planning resources and discussions of investment risks.

-

How is the interest rate (APY) on a money market account determined?

The interest rate on a money market account is influenced by several factors, including:

- Federal Reserve Policy: The Federal Reserve’s monetary policy, particularly the federal funds rate, has a significant impact on interest rates across the economy, including those offered on MMAs.

- Competition: Banks and credit unions compete for deposits, which can lead to higher APYs to attract customers.

- Economic Conditions: Overall economic conditions, such as inflation and economic growth, can also affect interest rates.

- Financial Institution’s Strategy: Each financial institution has its own strategy for setting interest rates based on its business goals and risk tolerance.

Source: Economic analyses and banking industry reports.

-

What steps should I take to open a money market account and start earning the 4.41% APY?

To open a money market account and start earning the attractive APY, follow these steps:

- Research and Compare: Research different banks and credit unions offering money market accounts and compare their APYs, fees, minimum balance requirements, and other features.

- Check Eligibility: Ensure you meet the eligibility requirements, such as being a U.S. citizen or resident and having a valid Social Security number.

- Gather Documentation: Gather the necessary documentation, such as a government-issued photo ID, proof of address (e.g., utility bill), and Social Security card.

- Apply Online or In-Person: Most banks and credit unions allow you to apply for a money market account online or in person at a branch.

- Fund the Account: Fund the account with the required minimum balance, if any, through a transfer from another bank account, a check, or cash deposit.

- Monitor Your Account: Regularly monitor your account to ensure you are earning the advertised APY and to keep track of your transactions.

Source: Banking application procedures and personal finance guides.

In-Depth Analysis of Money Market Accounts

The appeal of money market accounts extends beyond just a high APY; it’s rooted in a combination of safety, liquidity, and competitive returns. In an era where financial security is paramount, understanding the nuances of MMAs is crucial for making informed decisions about one’s savings.

Historical Context of Money Market Accounts

Money market accounts emerged in the 1970s as a response to regulations that limited the interest rates banks could offer on traditional savings accounts. These regulations, known as Regulation Q, were intended to protect banks but had the unintended consequence of stifling competition and limiting returns for savers. Money market funds, offered by investment companies, bypassed these regulations by investing in short-term debt securities and offering higher yields. In response, banks created money market deposit accounts (MMDAs), which were similar to money market funds but offered FDIC insurance.

Source: Historical financial regulations and banking industry evolution.

The Role of the Federal Funds Rate

The Federal Reserve’s monetary policy, particularly its control over the federal funds rate, plays a critical role in determining the interest rates offered on money market accounts. The federal funds rate is the target rate that the Federal Reserve wants banks to charge one another for the overnight lending of reserves. When the Fed raises the federal funds rate, it becomes more expensive for banks to borrow money, which in turn leads them to increase the interest rates they charge on loans and the interest rates they pay on deposits, including money market accounts. Conversely, when the Fed lowers the federal funds rate, it becomes less expensive for banks to borrow money, which can lead to lower interest rates on MMAs.

Source: Federal Reserve policy statements and economic analysis.

Impact of Inflation on Money Market Accounts

Inflation is a key consideration for savers when evaluating the attractiveness of money market accounts. If the inflation rate is higher than the APY earned on an MMA, the real value (purchasing power) of the savings will decrease over time. For example, if the inflation rate is 5% and the APY on an MMA is 4.41%, the real return is -0.59%. This means that while the nominal value of the savings is increasing, its ability to purchase goods and services is declining.

Source: Economic principles and inflation data.

Tax Implications of Money Market Accounts

The interest earned on money market accounts is generally taxable as ordinary income at the federal, state, and local levels. Savers will receive a 1099-INT form from the bank or credit union at the end of the year, reporting the amount of interest earned. It’s important to consider the tax implications when evaluating the overall return on an MMA. For example, if a saver is in the 22% tax bracket, a 4.41% APY would result in an after-tax return of approximately 3.44%.

Source: Tax regulations and financial planning advice.

Money Market Accounts vs. High-Yield Savings Accounts

Money market accounts and high-yield savings accounts are both deposit accounts that offer higher interest rates than traditional savings accounts. However, there are some key differences between the two:

- Interest Rates: MMAs typically offer slightly higher interest rates than high-yield savings accounts, although the difference may be small.

- Minimum Balance Requirements: MMAs often have higher minimum balance requirements than high-yield savings accounts.

- Transaction Limits: MMAs may have more restrictions on the number of transactions per month than high-yield savings accounts.

- Check-Writing Privileges: Some MMAs offer check-writing privileges, which are not typically available with high-yield savings accounts.

Source: Comparison of features across various savings accounts.

Money Market Accounts vs. Certificates of Deposit (CDs)

Certificates of deposit (CDs) are another popular savings option that offer fixed interest rates for a specific term. Here’s how they compare to money market accounts:

- Interest Rates: CDs typically offer higher interest rates than MMAs, especially for longer terms.

- Liquidity: MMAs are more liquid than CDs, as the funds can be accessed relatively easily. CDs, on the other hand, have a fixed term, and withdrawing the funds before the term expires may result in penalties.

- Flexibility: MMAs offer more flexibility than CDs, as the interest rates can adjust with market conditions. CDs offer a fixed interest rate for the entire term, providing more certainty but less flexibility.

Source: Comparison of features across various savings accounts and CDs.

The Impact of Technology on Money Market Accounts

Technology has played a significant role in the evolution of money market accounts, making it easier for savers to access and manage their accounts. Online and mobile banking platforms allow savers to:

- Open accounts online: The application process can be completed entirely online, without the need to visit a branch.

- Transfer funds electronically: Funds can be transferred between accounts quickly and easily.

- Monitor account activity: Savers can track their account balances and transactions in real-time.

- Access customer service: Online chat and email support provide convenient access to customer service.

Source: Trends in online banking and financial technology.

The Future of Savings Accounts

The landscape of savings accounts is constantly evolving, driven by technological innovation, changing consumer preferences, and regulatory developments. Some of the trends shaping the future of savings accounts include:

- Digital-only banks: These banks offer higher interest rates and lower fees than traditional banks, thanks to their lower overhead costs.

- Personalized savings tools: Banks are increasingly offering personalized savings tools that help savers set goals, track progress, and automate savings.

- Integration with financial planning apps: Savings accounts are becoming more integrated with financial planning apps, providing savers with a holistic view of their finances.

- Blockchain technology: Blockchain technology has the potential to revolutionize the way savings accounts are managed, by providing greater transparency, security, and efficiency.

Source: Future trends in the financial industry and the impact of technology.

Case Studies: Successful Use of Money Market Accounts

To illustrate the practical benefits of money market accounts, consider the following case studies:

- Case Study 1: Saving for a Down Payment: Sarah, a young professional, is saving for a down payment on a house. She opened a money market account with a 4.41% APY and contributes a fixed amount each month. The higher interest rate helps her reach her savings goal faster than she would with a traditional savings account.

- Case Study 2: Emergency Fund: John, a retiree, keeps his emergency fund in a money market account. The account provides a safe and liquid place to store his funds, ensuring they are available when needed while earning a competitive interest rate.

- Case Study 3: Short-Term Investment: Mary, a small business owner, uses a money market account to store funds for short-term investments. The account provides a higher return than a traditional checking account, allowing her to maximize her earnings while maintaining easy access to her funds.

Source: Hypothetical scenarios based on financial planning principles.

Conclusion: The Enduring Value of Money Market Accounts

Money market accounts remain a valuable tool for savers looking to balance safety, liquidity, and competitive returns. While the specific APY offered on MMAs may fluctuate with market conditions, the underlying principles of these accounts remain the same: to provide a secure and accessible place to store cash while earning a higher interest rate than traditional savings accounts. By understanding the features, benefits, and potential risks of MMAs, individuals can make informed decisions about how to best utilize these accounts to achieve their financial goals.

The current environment, with APYs reaching 4.41%, underscores the importance of actively managing one’s savings and taking advantage of opportunities to maximize returns. Whether saving for a short-term goal, building an emergency fund, or simply seeking a safe haven for cash, money market accounts offer a compelling solution for a wide range of savers. As the financial landscape continues to evolve, staying informed about the latest trends and opportunities in the savings account market is essential for achieving long-term financial success.