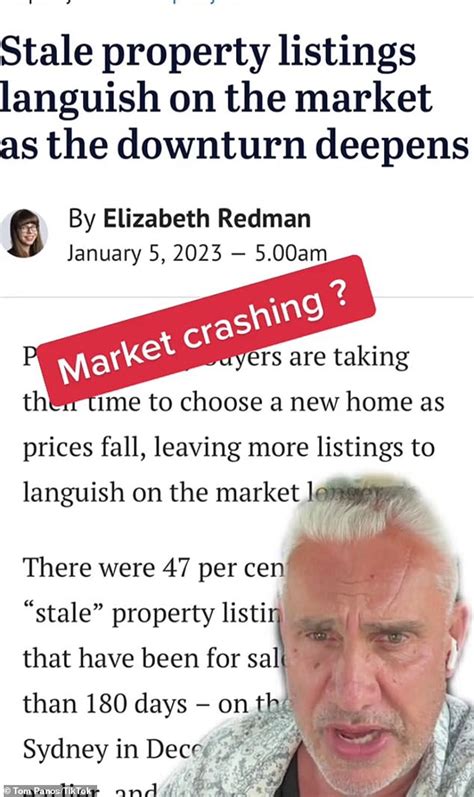

Home sellers are facing a harsh dose of reality as the housing market cools, with an increasing number discovering their initial asking prices are overly optimistic, leading to price reductions and longer listing times. A recent viral social media post encapsulated this sentiment, highlighting the disconnect between seller expectations and current market conditions, signaling a shift in power towards buyers.

The U.S. housing market is undergoing a significant correction, forcing sellers to reassess their pricing strategies after enjoying a period of unprecedented demand and rapidly rising prices during the pandemic. The once-frenzied market, characterized by bidding wars and offers well above asking price, has given way to a more balanced environment where buyers are exercising greater caution and demanding more reasonable valuations. Inventory is rising, mortgage rates remain elevated, and economic uncertainty is contributing to a slowdown in sales activity.

“Dear price, too high,” reads the brutally honest assessment circulating online, epitomizing the challenges sellers now face. This succinct message underscores the core issue: many sellers are still clinging to inflated expectations based on peak market conditions, failing to adjust to the new reality.

Market Dynamics and Correction

The housing market’s rapid ascent was fueled by record-low interest rates, government stimulus measures, and a surge in demand as people sought more space and better living environments during the pandemic. This confluence of factors led to a severe shortage of homes for sale, driving prices to unsustainable levels. However, as the Federal Reserve began raising interest rates to combat inflation, the housing market started to cool.

Higher mortgage rates have significantly reduced buyer affordability, leading to a decrease in demand. This, in turn, has increased the supply of homes on the market, giving buyers more options and negotiating power. The days of homes selling within hours or days of being listed are largely over, and sellers are now having to wait longer to find a buyer.

“We’re seeing a significant increase in the number of homes on the market, and buyers are becoming much more discerning,” says Sarah Jones, a real estate agent with XYZ Realty. “They’re no longer willing to overpay for a property, and they’re expecting homes to be in excellent condition and priced competitively.”

The Impact on Sellers

For sellers who listed their homes during the peak of the market, the current conditions can be particularly challenging. Many of these sellers set their asking prices based on recent comparable sales (comps) that reflected the inflated values of the time. However, those comps are now outdated, and buyers are looking at more recent sales data that reflects the current market conditions.

As a result, many sellers are finding that they need to reduce their asking prices in order to attract buyers. Price reductions are becoming increasingly common, and some sellers are even having to reduce their prices multiple times before finding a buyer.

“It’s a tough pill to swallow for sellers who were expecting to get top dollar for their homes,” says John Smith, a real estate analyst with ABC Research. “But the reality is that the market has changed, and they need to adjust their expectations accordingly.”

The longer a home sits on the market, the less attractive it becomes to buyers. Buyers often assume that there is something wrong with a property that has been listed for an extended period of time, even if that is not the case. This can lead to further price reductions and ultimately a lower sale price.

Strategies for Sellers in a Cooling Market

In order to succeed in a cooling market, sellers need to be realistic about their pricing and be prepared to negotiate with buyers. Here are some strategies that sellers can use to increase their chances of a successful sale:

- Price competitively: Research recent comparable sales in the area and price the home accordingly. Avoid overpricing the home, as this will likely deter buyers.

- Make necessary repairs and improvements: Buyers are more likely to be attracted to homes that are in good condition. Consider making necessary repairs and improvements before listing the home.

- Stage the home: Staging can help to make the home more appealing to buyers. Consider hiring a professional stager or simply decluttering and arranging the furniture in an appealing way.

- Be flexible with negotiations: Be prepared to negotiate with buyers on price, closing costs, and other terms of the sale.

- Work with an experienced real estate agent: An experienced real estate agent can provide valuable guidance and support throughout the selling process. They can help to price the home competitively, market it effectively, and negotiate with buyers on the seller’s behalf.

- Consider offering incentives: In a buyer’s market, offering incentives can make your property stand out. These could include paying for some of the buyer’s closing costs, offering a home warranty, or including appliances in the sale.

- Highlight the property’s unique features: Focus on what makes your property special. This could be its location, its amenities, or its unique design.

- Be patient: It may take longer to sell a home in a cooling market than it did in a hot market. Be patient and don’t get discouraged if the home doesn’t sell immediately.

- Consider a pre-listing inspection: This allows you to address any potential issues upfront, giving buyers confidence in the property’s condition. It can also prevent surprises that could derail a sale later on.

- Improve curb appeal: First impressions matter. Make sure the exterior of your home is well-maintained and inviting. This includes landscaping, painting, and ensuring the front door and entryway are clean and appealing.

The Role of Real Estate Agents

Real estate agents play a crucial role in helping sellers navigate the complexities of a changing market. Experienced agents have a deep understanding of local market conditions and can provide valuable advice on pricing, marketing, and negotiation.

“A good real estate agent will be able to provide sellers with accurate data on recent sales in their area and help them to develop a pricing strategy that is both competitive and realistic,” says Lisa Brown, a real estate consultant. “They will also be able to provide guidance on how to prepare the home for sale and market it effectively to potential buyers.”

In addition to providing market expertise, real estate agents can also act as intermediaries between sellers and buyers, helping to facilitate negotiations and resolve any issues that may arise. They can also help to ensure that all of the necessary paperwork is completed correctly and that the transaction closes smoothly.

Economic Factors at Play

Several economic factors are contributing to the cooling of the housing market. As mentioned earlier, the Federal Reserve’s interest rate hikes are a major driver. Higher interest rates not only make mortgages more expensive, but they also tend to slow down economic growth, which can further dampen demand for housing.

Inflation is another key factor. The rising cost of goods and services is putting a strain on household budgets, leaving less money available for housing. This is particularly true for first-time homebuyers, who are often the most sensitive to changes in affordability.

Economic uncertainty is also playing a role. Concerns about a potential recession, job losses, and geopolitical instability are making buyers more cautious. Many potential buyers are choosing to wait on the sidelines until the economic outlook becomes clearer.

Long-Term Outlook

While the housing market is currently undergoing a correction, most experts do not expect a repeat of the housing market crash of 2008. The fundamentals of the housing market are much stronger today than they were back then.

Lending standards are tighter, and there is less speculation in the market. Additionally, the supply of homes is still relatively low in many areas, which should help to support prices.

“We’re not expecting a major collapse in home prices,” says David Miller, an economist with XYZ Financial. “We’re expecting a gradual correction, with prices stabilizing over the next few years.”

However, the pace and extent of the correction will vary depending on local market conditions. Some areas that experienced the most rapid price appreciation during the pandemic are likely to see the biggest price declines. Other areas with more stable economies and lower housing costs are likely to fare better.

Advice for Buyers

The cooling of the housing market presents opportunities for buyers who have been priced out of the market in recent years. With more homes to choose from and less competition, buyers have more negotiating power and are more likely to find a home that meets their needs and budget.

Here are some tips for buyers in a cooling market:

- Get pre-approved for a mortgage: This will give you a clear idea of how much you can afford and will make you a more attractive buyer to sellers.

- Take your time: Don’t feel pressured to make a quick decision. Take your time to research different neighborhoods and properties and find a home that is right for you.

- Negotiate aggressively: Don’t be afraid to make a low offer. Sellers are more likely to be willing to negotiate in a cooling market.

- Get a home inspection: A home inspection can help to identify any potential problems with the property before you buy it.

- Be prepared to walk away: If you’re not comfortable with the price or terms of the sale, be prepared to walk away. There are likely to be other homes available that will meet your needs.

- Consider a fixer-upper: If you’re willing to put in some work, you may be able to find a fixer-upper at a lower price.

- Look for motivated sellers: Some sellers may be more motivated than others to sell their homes. This could be due to financial difficulties, relocation, or other factors.

- Work with an experienced real estate agent: An experienced real estate agent can provide valuable guidance and support throughout the buying process.

The Social Media Impact

The viral nature of the “Dear price, too high” message reflects the growing frustration among potential homebuyers who have been priced out of the market for years. Social media has become a powerful tool for sharing information and opinions about the housing market, and it is playing a significant role in shaping public perception.

The message has resonated with many people who feel that home prices have become detached from reality. It has also sparked a broader conversation about the affordability crisis and the challenges facing first-time homebuyers.

The social media buzz highlights the shift in sentiment. Buyers, once desperate to secure a property, now feel empowered to demand fair prices. Sellers who ignore this shift risk having their properties linger on the market, ultimately leading to deeper price cuts.

Conclusion

The U.S. housing market is undergoing a significant correction, and sellers are facing a new reality. The days of easy sales and inflated prices are over, and sellers need to adjust their expectations and pricing strategies accordingly. By pricing competitively, making necessary repairs and improvements, and working with an experienced real estate agent, sellers can increase their chances of a successful sale in a cooling market. For buyers, the current market conditions present opportunities to find a home that meets their needs and budget. The market is rebalancing, and while adjustments may be difficult for some sellers, this shift towards a more sustainable and buyer-friendly environment is crucial for the long-term health of the housing market. The “Dear price, too high” sentiment serves as a clear warning: adapt or risk getting left behind.

Frequently Asked Questions (FAQ)

1. Why are home prices falling in some areas?

Home prices are falling in some areas due to a combination of factors, including:

- Rising Mortgage Rates: The Federal Reserve’s interest rate hikes have increased mortgage rates, making it more expensive for people to buy homes. This has reduced demand and put downward pressure on prices.

- Increased Inventory: The number of homes for sale has increased in many areas, giving buyers more options and reducing competition.

- Economic Uncertainty: Concerns about a potential recession and job losses are making buyers more cautious.

- Inflation: High inflation is straining household budgets, leaving less money available for housing.

- Shift in Buyer Sentiment: Buyers are no longer willing to overpay for properties as they were during the peak of the pandemic-era housing boom.

2. Is this a good time to buy a home?

Whether it’s a good time to buy a home depends on individual circumstances and financial situation. However, the cooling housing market presents potential advantages for buyers:

- More Options: Increased inventory means buyers have more homes to choose from.

- Less Competition: Fewer bidding wars and less pressure to make quick decisions.

- Negotiating Power: Buyers have more leverage to negotiate prices and terms of the sale.

- Potential for Price Reductions: Some sellers are reducing their asking prices to attract buyers.

It’s essential to consider factors like job security, long-term financial goals, and the specific local market conditions before making a decision. Consulting with a financial advisor and a real estate agent can provide personalized guidance.

3. What should sellers do to attract buyers in a cooling market?

To attract buyers in a cooling market, sellers should:

- Price Competitively: Research recent comparable sales in the area and price the home accordingly. Avoid overpricing the home.

- Make Necessary Repairs and Improvements: Ensure the home is in good condition. Address any deferred maintenance items.

- Stage the Home: Present the home in its best light by decluttering, cleaning, and arranging furniture in an appealing way.

- Offer Incentives: Consider offering incentives such as paying for some of the buyer’s closing costs, a home warranty, or including appliances in the sale.

- Work with an Experienced Real Estate Agent: A knowledgeable agent can provide valuable guidance and support throughout the selling process.

- Highlight the Property’s Unique Features: Focus on what makes the property special and attractive to buyers.

- Be Flexible with Negotiations: Be prepared to negotiate on price and other terms of the sale.

4. Will home prices crash like they did in 2008?

Most experts do not expect a repeat of the 2008 housing market crash for several reasons:

- Tighter Lending Standards: Lending standards are much stricter now than they were in 2008, reducing the risk of widespread defaults.

- Less Speculation: There is less speculative activity in the market today.

- Inventory Levels: While inventory is rising, it is still relatively low in many areas, which should help to support prices.

- Stronger Economy: The overall economy is in better shape than it was in 2008.

While a significant price decline is unlikely, a gradual correction or stabilization of prices is expected in many markets.

5. How long will the housing market correction last?

The duration of the housing market correction is uncertain and will depend on various factors, including:

- Federal Reserve Policy: The Federal Reserve’s future interest rate decisions will significantly impact mortgage rates and housing demand.

- Economic Growth: The overall health of the economy will influence buyer confidence and demand for housing.

- Inflation: The pace of inflation will affect household budgets and affordability.

- Housing Supply: The level of housing inventory will continue to play a role in price dynamics.

Some experts predict that the correction will last for several months or even a few years, while others believe that the market will stabilize relatively quickly. It is essential to monitor market trends and consult with real estate professionals for the latest insights.