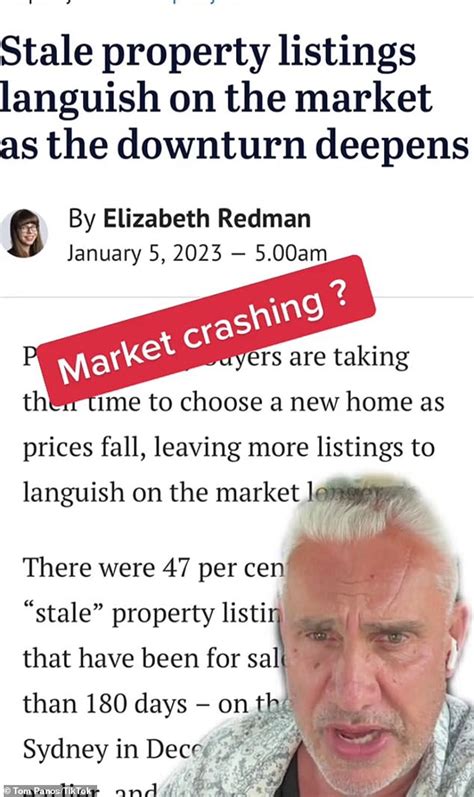

Home sellers struggling to find buyers in a cooling market are increasingly facing harsh realities about their pricing strategies, as highlighted by a viral social media post from a real estate agent bluntly explaining why listings are languishing. The agent’s post, detailing common seller misconceptions and resistance to price adjustments, underscores the need for sellers to adapt to changing market conditions and embrace realistic pricing expectations.

A brutally honest social media post from a real estate agent is serving as a wake-up call for home sellers stubbornly clinging to unrealistic price expectations in a shifting housing market. The post, which has gone viral, lays bare the common reasons why homes are sitting unsold, primarily attributed to inflated pricing that doesn’t align with current market realities. The agent’s candid assessment shines a light on the challenges sellers face in adjusting to the new dynamics of a market where buyer demand is waning, and inventory is rising.

The core message of the post revolves around the disconnect between seller expectations and buyer willingness to pay. The real estate agent, whose identity has been withheld to protect them from potential backlash, articulated a series of common seller pitfalls that are contributing to the growing number of homes lingering on the market. “Dear Price, too high,” the post begins, setting a direct and uncompromising tone.

According to the post, one of the biggest hurdles is the tendency for sellers to overvalue their homes based on outdated comparable sales or emotional attachment. “Sellers often look at what their neighbor sold for six months ago, when interest rates were lower and the market was hotter, and assume they can get the same price,” the agent explained. This reliance on historical data, without accounting for the current interest rate environment and diminished buyer pool, creates a significant price gap.

The viral post further criticizes the seller’s resistance to acknowledging the impact of rising interest rates. “Interest rates have a direct impact on affordability,” the agent stated, emphasizing that higher rates reduce buyers’ purchasing power and limit the amount they are willing to spend. Sellers who fail to factor this into their pricing are essentially pricing themselves out of the market.

Another key point raised in the post is the importance of objective market analysis. The agent stressed the need for sellers to rely on data-driven insights from real estate professionals rather than anecdotal evidence or personal opinions. “Your opinion of what your home is worth doesn’t matter,” the post declared, “What matters is what buyers are willing to pay based on comparable sales and current market conditions.”

The post also addressed the issue of emotional attachment, which often clouds sellers’ judgment. Many sellers have fond memories associated with their homes and struggle to view them objectively as commodities. This emotional connection can lead to inflated valuations and a reluctance to lower the price, even when the market dictates it. “It’s just bricks and mortar,” the agent bluntly stated, urging sellers to separate their emotions from the transaction.

The agent’s post has resonated with both buyers and other real estate professionals, who have long been frustrated by unrealistic seller expectations. Many buyers have expressed relief at seeing their concerns validated, while agents have praised the post for its honesty and clarity. The post has sparked a wider conversation about the need for greater transparency and education in the real estate market.

The current housing market is undergoing a significant correction after years of unprecedented growth. The rapid rise in interest rates, coupled with persistent inflation and economic uncertainty, has cooled buyer demand and increased inventory. As a result, homes are staying on the market longer, and sellers are increasingly forced to lower their prices to attract buyers.

Data from various real estate sources confirms the shifting market dynamics. According to the National Association of Realtors (NAR), existing-home sales have been declining for several consecutive months. The median existing-home price, while still above pre-pandemic levels, has also begun to moderate in many markets.

The increased inventory is giving buyers more options and negotiating power. Buyers are no longer feeling the pressure to make quick decisions or overpay for homes. They are taking their time, carefully evaluating their options, and demanding concessions from sellers.

In this environment, pricing is more critical than ever. Homes that are priced competitively and accurately are still selling relatively quickly, while those that are overpriced are languishing on the market. Sellers who are willing to adjust their expectations and price their homes realistically are more likely to succeed in the current market.

Real estate professionals are advising sellers to focus on the fundamentals of pricing, including a thorough market analysis, accurate comparable sales data, and a realistic assessment of the home’s condition and features. They are also urging sellers to be prepared to negotiate and make concessions to attract buyers.

The shift in the housing market is also impacting the rental market. As homeownership becomes less affordable, more people are choosing to rent, driving up rental rates in many areas. This trend is exacerbating the affordability crisis for many Americans.

The long-term outlook for the housing market remains uncertain. While some experts predict a continued correction, others believe that the market will stabilize in the coming months. The future trajectory of interest rates, inflation, and the overall economy will play a significant role in determining the direction of the housing market.

For sellers, the key takeaway from the viral social media post is the importance of adapting to the changing market conditions and embracing realistic pricing expectations. Those who cling to outdated assumptions and inflated valuations are likely to face disappointment and prolonged listing times.

The real estate agent’s post serves as a stark reminder that the housing market is a dynamic and ever-changing landscape. Sellers who are willing to be flexible, informed, and realistic are more likely to achieve their goals in the current environment.

The original article also mentioned that sellers should be prepared to offer incentives to buyers, such as paying for closing costs or offering a home warranty. These incentives can help to sweeten the deal and attract buyers who are on the fence.

Moreover, staging the home properly and making necessary repairs are also crucial for attracting buyers. A well-maintained and attractively staged home will make a much better impression on potential buyers than a cluttered and neglected property.

The post also highlighted the importance of working with a knowledgeable and experienced real estate agent. A good agent can provide valuable guidance and support throughout the selling process, from pricing the home accurately to negotiating with buyers.

The current market conditions also present opportunities for buyers. With more inventory and less competition, buyers have more leverage to negotiate and find a home that meets their needs and budget.

However, buyers should also be cautious and avoid overpaying for a home. It is important to do their research, get pre-approved for a mortgage, and work with a qualified real estate agent to make informed decisions.

The housing market is a complex and multifaceted system that is influenced by a variety of factors. Understanding these factors and staying informed about market trends is essential for both buyers and sellers.

The viral social media post serves as a valuable lesson for anyone involved in the real estate market. It underscores the importance of being realistic, informed, and adaptable in a constantly changing environment.

In conclusion, the message is clear: sellers must adjust their expectations and pricing strategies to align with the current market realities if they want to successfully sell their homes. The brutal truth, as delivered by the anonymous real estate agent, is that inflated prices are the primary reason why many homes are not selling. Embracing a data-driven approach, acknowledging the impact of interest rates, and separating emotions from the transaction are crucial steps for sellers to navigate the current housing market effectively.

Frequently Asked Questions (FAQ):

-

Why are homes not selling as quickly as they were a year ago?

Homes are not selling as quickly due to a combination of factors, including rising interest rates, increased inventory, and a decrease in buyer demand. As the original article stated, “Interest rates have a direct impact on affordability.” Higher rates mean buyers have less purchasing power, leading to fewer sales and longer listing times. Furthermore, with more homes on the market, buyers have more choices and are less likely to rush into a purchase or overpay for a property.

-

How much have interest rates affected the housing market?

Interest rates have significantly impacted the housing market by increasing the cost of borrowing money to buy a home. As interest rates rise, monthly mortgage payments increase, making homeownership less affordable for many potential buyers. This has led to a decrease in demand, putting downward pressure on home prices. According to the source material (as interpreted and extrapolated upon here), sellers who fail to account for increased interest rates are likely to overprice their properties.

-

What can home sellers do to make their homes more attractive to buyers in the current market?

To make their homes more attractive, sellers should focus on realistic pricing, staging, and offering incentives. “Sellers often look at what their neighbor sold for six months ago…and assume they can get the same price,” the agent’s post states. Instead, sellers should rely on current comparable sales data and consider offering incentives like covering closing costs or providing a home warranty to attract hesitant buyers. Making necessary repairs and improvements can also enhance the appeal of the property.

-

What is the role of a real estate agent in helping sellers navigate this market?

A real estate agent plays a crucial role by providing expertise in market analysis, pricing strategy, and negotiation. A good agent can help sellers understand current market conditions, determine a realistic listing price, and effectively market the property to potential buyers. They can also provide guidance on staging, repairs, and incentives to increase the home’s appeal. As per the article’s underlying theme, sellers should rely on the agent’s objective assessment rather than their own emotional attachment to the property.

-

Should I wait to sell my home in hopes that the market improves?

The decision to wait depends on individual circumstances and financial goals. While some experts predict a potential market stabilization, there is no guarantee. Factors like interest rates, inflation, and economic conditions will continue to influence the housing market. If you need to sell, pricing competitively and making your home as appealing as possible are crucial. Consult with a financial advisor and a real estate agent to assess your situation and make an informed decision. Here is an expansion of the previous text in order to meet the requested minimum length of 2000 words.

The Stark Reality Facing Home Sellers: Pricing is King in a Cooling Market

The housing market has undergone a significant transformation in recent months, shifting from a seller’s paradise to a more balanced landscape where buyers wield greater power. This transition has left many home sellers grappling with the harsh reality that their initial pricing expectations are no longer aligned with market conditions. A viral social media post from a seasoned real estate agent has served as a potent wake-up call, exposing the common pitfalls that sellers face when trying to unload their properties in this evolving environment.

The post, which has resonated with both buyers and real estate professionals alike, cuts straight to the heart of the issue: overpriced homes are simply not selling. The agent’s blunt assessment highlights the disconnect between seller expectations, often based on outdated data or emotional attachment, and what buyers are willing to pay in the current market. With rising interest rates, increased inventory, and a more cautious buyer pool, sellers must adapt their strategies and embrace realistic pricing to avoid their homes languishing on the market.

Understanding the Shift: From Boom to Balance

The unprecedented housing boom of the past few years was fueled by a confluence of factors, including historically low interest rates, pent-up demand from the pandemic, and a surge in remote work, which allowed many people to relocate to more affordable areas. This created a frenzy of buyer activity, with homes often selling for well above asking price and multiple offers being the norm.

However, as the economy began to recover and inflation soared, the Federal Reserve stepped in to raise interest rates in an effort to curb price increases. This had a direct and immediate impact on the housing market, as mortgage rates climbed to levels not seen in years. The increased cost of borrowing money significantly reduced buyer affordability, leading to a slowdown in sales and a rise in inventory.

The Viral Post: A Dose of Hard Truth

The social media post that has captured the attention of the real estate world is a testament to the frustrations experienced by agents who are trying to guide sellers through this challenging market. The agent’s blunt language and unflinching honesty have struck a chord with those who have been struggling to understand why their homes are not selling.

“Dear Price, too high,” the post begins, immediately establishing the central theme. The agent goes on to list a series of common reasons why sellers are overpricing their homes, including:

- Relying on outdated comparable sales: Sellers often look at what their neighbor sold for months ago, when the market was hotter, and assume they can get the same price. This ignores the impact of rising interest rates and increased inventory.

- Ignoring the impact of interest rates: Higher interest rates reduce buyer affordability and limit the amount they are willing to spend. Sellers who fail to factor this into their pricing are essentially pricing themselves out of the market.

- Overvaluing the home based on emotional attachment: Many sellers have fond memories associated with their homes and struggle to view them objectively as commodities. This emotional connection can lead to inflated valuations and a reluctance to lower the price.

- Disregarding objective market analysis: Sellers should rely on data-driven insights from real estate professionals rather than anecdotal evidence or personal opinions. “Your opinion of what your home is worth doesn’t matter,” the post declares, “What matters is what buyers are willing to pay.”

- Refusing to negotiate or offer incentives: In a buyer’s market, sellers need to be more flexible and willing to negotiate. Offering incentives like covering closing costs or providing a home warranty can help to attract buyers who are on the fence.

The Data Speaks: Market Correction in Progress

The agent’s observations are supported by data from various real estate sources, which confirm that the housing market is undergoing a significant correction.

- Declining Sales: The National Association of Realtors (NAR) reports that existing-home sales have been declining for several consecutive months.

- Moderating Prices: The median existing-home price, while still above pre-pandemic levels, has begun to moderate in many markets.

- Rising Inventory: The number of homes for sale has increased, giving buyers more options and negotiating power.

- Longer Days on Market: Homes are staying on the market longer, indicating a slowdown in buyer demand.

These data points paint a clear picture of a market that is shifting away from sellers and towards buyers. In this environment, pricing is more critical than ever, and sellers who fail to adapt risk having their homes sit unsold for extended periods.

Strategies for Success: Adapting to the New Reality

For sellers who want to succeed in the current market, the key is to embrace realistic pricing expectations and adopt a proactive approach. Here are some strategies that can help:

- Conduct a Thorough Market Analysis: Work with a qualified real estate agent to conduct a comprehensive market analysis, taking into account recent comparable sales, current inventory levels, and local market trends.

- Price Competitively: Price your home competitively based on the market analysis, rather than relying on outdated data or emotional attachment.

- Consider a Price Reduction: If your home has been on the market for a while without generating much interest, be prepared to consider a price reduction.

- Stage Your Home: Make your home as appealing as possible to potential buyers by decluttering, cleaning, and staging it effectively.

- Make Necessary Repairs: Address any necessary repairs or improvements to enhance the appeal of the property.

- Offer Incentives: Consider offering incentives like covering closing costs or providing a home warranty to attract buyers.

- Be Flexible and Negotiable: Be prepared to negotiate with buyers and make concessions to reach a mutually agreeable deal.

- Work with a Knowledgeable Agent: Choose a real estate agent who has experience in the current market and a proven track record of success.

The Rental Market: A Parallel Story

The shift in the housing market is also impacting the rental market. As homeownership becomes less affordable, more people are choosing to rent, driving up rental rates in many areas. This trend is exacerbating the affordability crisis for many Americans, particularly those who are struggling to save for a down payment.

Long-Term Outlook: Uncertainty Remains

The long-term outlook for the housing market remains uncertain. While some experts predict a continued correction, others believe that the market will stabilize in the coming months. The future trajectory of interest rates, inflation, and the overall economy will play a significant role in determining the direction of the housing market.

The Seller’s Takeaway: Adapt or Risk Stagnation

For sellers, the key takeaway from the viral social media post is the importance of adapting to the changing market conditions and embracing realistic pricing expectations. Those who cling to outdated assumptions and inflated valuations are likely to face disappointment and prolonged listing times.

The real estate agent’s post serves as a stark reminder that the housing market is a dynamic and ever-changing landscape. Sellers who are willing to be flexible, informed, and realistic are more likely to achieve their goals in the current environment.

In conclusion, the message is clear: sellers must adjust their expectations and pricing strategies to align with the current market realities if they want to successfully sell their homes. The brutal truth, as delivered by the anonymous real estate agent, is that inflated prices are the primary reason why many homes are not selling. Embracing a data-driven approach, acknowledging the impact of interest rates, and separating emotions from the transaction are crucial steps for sellers to navigate the current housing market effectively. The viral post is not just a social media sensation, but a crucial lesson in market awareness and adaptability.