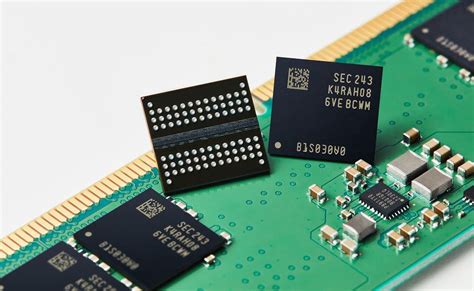

China’s leading memory chip manufacturer, ChangXin Memory Technologies (CXMT), is reportedly halting production of DDR4 memory chips in favor of developing more advanced memory technologies like DDR5, LPDDR5, and potentially even pushing towards High Bandwidth Memory (HBM), allegedly under the direction of the Chinese government. This shift signals a move away from older technologies amidst escalating geopolitical tensions and increasing demand for higher-performance memory solutions.

ChangXin Memory Technologies (CXMT), China’s top DRAM manufacturer, is diverting its resources away from producing DDR4 memory chips to focus on developing advanced memory technologies like DDR5 and LPDDR5, and potentially even HBM, as per a new report. This strategic realignment is purportedly at the behest of the Chinese government, aiming to bolster the nation’s competitiveness in the global semiconductor market. The decision reflects a calculated effort to catch up with international memory technology leaders, particularly in the face of escalating trade restrictions and technological barriers.

According to industry sources, CXMT’s decision is driven by a combination of factors. First, the global demand for DDR4 memory, while still significant, is gradually being superseded by DDR5 in newer computing platforms. Second, the Chinese government is prioritizing the development of cutting-edge technologies to reduce reliance on foreign suppliers, particularly in strategic sectors like semiconductors. Finally, the move could position CXMT to capture a larger share of the high-end memory market, which is dominated by companies like Samsung, SK Hynix, and Micron.

The move is significant because CXMT has been one of the primary suppliers of DDR4 memory in the Chinese market, and the shift could potentially create a temporary supply gap. However, it also signals a more significant long-term strategy by China to become a self-sufficient and competitive player in the global memory market. This realignment also comes at a time when the U.S. government has been actively seeking to restrict China’s access to advanced semiconductor technology.

“The move is seen as an effort to reduce reliance on older technologies and catch up with international memory technology leaders like Samsung and SK Hynix,” the original report noted.

The decision to prioritize DDR5 and LPDDR5 development underscores the growing demand for these memory technologies in next-generation computing devices, including high-performance PCs, servers, and mobile devices. LPDDR5, in particular, is crucial for smartphones and other portable devices due to its low power consumption and high bandwidth. The potential push towards HBM indicates a longer-term ambition to compete in the high-performance computing and artificial intelligence markets, where HBM is becoming increasingly essential.

Context and Background

ChangXin Memory Technologies (CXMT) was established in 2016 with the explicit goal of building a domestic DRAM industry in China. Backed by significant government funding, CXMT has rapidly grown into a major player in the Chinese memory market. The company initially focused on producing DDR4 memory, which is widely used in PCs and servers. However, as technology has advanced, the demand for newer memory standards like DDR5 and LPDDR5 has increased.

The global memory market is dominated by a few key players: Samsung, SK Hynix, and Micron. These companies invest heavily in research and development to stay ahead of the technology curve. China has long sought to reduce its reliance on these foreign suppliers and build its own domestic memory industry. CXMT is at the forefront of this effort.

The decision to shift away from DDR4 production also comes amid increasing geopolitical tensions between the United States and China. The U.S. government has imposed restrictions on the export of advanced semiconductor technology to China, citing national security concerns. These restrictions have made it more difficult for Chinese companies to access the latest manufacturing equipment and intellectual property, thereby hindering their ability to compete in the global market.

In response to these challenges, the Chinese government has ramped up its support for the domestic semiconductor industry, providing funding, tax incentives, and other forms of assistance. The government’s goal is to create a self-sufficient semiconductor ecosystem that can meet the country’s growing demand for chips.

Implications for the Market

CXMT’s decision to halt DDR4 production could have several implications for the memory market.

- Potential Supply Shortages: In the short term, the move could lead to supply shortages of DDR4 memory, particularly in the Chinese market. Other manufacturers may be able to fill the gap, but it could take time for them to ramp up production.

- Increased Prices: Reduced supply could also lead to higher prices for DDR4 memory. This would affect consumers and businesses that rely on DDR4-based devices.

- Accelerated Adoption of DDR5: The shift could accelerate the adoption of DDR5 memory, as consumers and businesses look for alternative solutions. This would benefit companies that are already producing DDR5 memory, such as Samsung, SK Hynix, and Micron.

- Increased Competition in Advanced Memory Technologies: CXMT’s focus on DDR5, LPDDR5, and HBM could intensify competition in these segments of the market. This could lead to innovation and lower prices for these technologies.

- Strategic Implications: The move underscores China’s determination to become a leader in the global semiconductor industry. It also highlights the growing importance of memory technology in modern computing and the strategic implications of controlling its supply.

Technical Details of Memory Technologies

- DDR4 (Double Data Rate 4): DDR4 is a type of synchronous dynamic random-access memory (SDRAM) with a high bandwidth (“double data rate”) interface. It’s been widely used in computers since 2014.

- DDR5 (Double Data Rate 5): DDR5 is the successor to DDR4, offering increased bandwidth, higher clock speeds, and improved power efficiency. It is the latest generation of DRAM, offering significant performance improvements over DDR4.

- LPDDR5 (Low Power Double Data Rate 5): LPDDR5 is a type of low-power DRAM designed for mobile devices like smartphones and tablets. It offers high bandwidth and low power consumption, making it ideal for battery-powered devices.

- HBM (High Bandwidth Memory): HBM is a type of high-performance memory that is designed for use in high-end graphics cards, servers, and other demanding applications. It features a wide memory bus and high bandwidth, making it suitable for applications that require large amounts of data to be processed quickly. HBM is stacked vertically, allowing for much higher density and bandwidth than traditional memory technologies.

Government Influence

The Chinese government’s role in CXMT’s decision is a critical aspect of this development. The government has been actively promoting the growth of the domestic semiconductor industry through various means, including funding, policy support, and strategic directives. The decision to shift away from DDR4 production appears to be a direct result of government guidance, aimed at accelerating the development of more advanced memory technologies.

This level of government involvement is not unique to China. Many countries have industrial policies aimed at supporting strategic industries, but China’s approach is often more assertive and interventionist. The government sees the semiconductor industry as a critical component of its economic and national security, and it is willing to take bold steps to ensure its success.

Challenges and Opportunities for CXMT

While the shift towards advanced memory technologies presents significant opportunities for CXMT, it also poses several challenges.

- Technological Expertise: Developing advanced memory technologies like DDR5, LPDDR5, and HBM requires significant technological expertise. CXMT will need to invest heavily in research and development to catch up with the leading memory manufacturers.

- Manufacturing Capabilities: Manufacturing these technologies requires advanced manufacturing equipment and processes. CXMT will need to acquire the necessary equipment and develop the expertise to operate it effectively.

- Intellectual Property: Memory technology is heavily protected by patents. CXMT will need to navigate the complex landscape of intellectual property rights and ensure that it does not infringe on the patents of other companies.

- Market Acceptance: Even if CXMT can successfully develop and manufacture advanced memory technologies, it will need to gain market acceptance. This will require building a reputation for quality and reliability.

Despite these challenges, CXMT has several advantages. It has the backing of the Chinese government, which is willing to provide the necessary funding and support. It also has access to the large and growing Chinese market, which provides a ready market for its products. Additionally, the ongoing geopolitical tensions between the United States and China could create opportunities for CXMT to gain market share, as Chinese companies look for domestic suppliers.

Global Semiconductor Landscape

The global semiconductor industry is a complex and dynamic ecosystem. It is characterized by intense competition, rapid technological change, and increasing geopolitical tensions. The industry is also highly concentrated, with a few key players dominating the market.

The United States, South Korea, and Taiwan are the leading countries in the semiconductor industry. The United States is home to many of the leading semiconductor companies, including Intel, Nvidia, and Qualcomm. South Korea is home to Samsung and SK Hynix, which are the world’s leading memory manufacturers. Taiwan is home to TSMC, which is the world’s largest contract chip manufacturer.

China is rapidly emerging as a major player in the semiconductor industry. The Chinese government has made the development of the semiconductor industry a national priority, and it is investing heavily in research and development, manufacturing, and talent development. Chinese companies are making rapid progress in catching up with the leading semiconductor companies.

The increasing competition between the United States and China in the semiconductor industry is likely to have a significant impact on the global market. It could lead to increased innovation, lower prices, and a more diversified supply chain. However, it could also lead to increased trade tensions and geopolitical instability.

Impact on Consumers and Businesses

The developments in the memory market, including CXMT’s decision to shift away from DDR4 production, will ultimately impact consumers and businesses.

- Consumers: Consumers may see higher prices for DDR4-based devices in the short term. However, the accelerated adoption of DDR5 memory could lead to improved performance and lower prices in the long term.

- Businesses: Businesses may need to upgrade their computing infrastructure to take advantage of the benefits of DDR5 memory. This could require significant investment, but it could also lead to improved productivity and efficiency.

- Data Centers: Data centers, which rely heavily on memory technology, will be particularly affected by these developments. The adoption of DDR5 and HBM could lead to significant improvements in data center performance and energy efficiency.

- Gaming Industry: The gaming industry, which is always pushing the limits of computing technology, will also benefit from the advancements in memory technology. DDR5 and HBM can enable more realistic and immersive gaming experiences.

Long-Term Outlook

The long-term outlook for the memory market is positive. The demand for memory is expected to continue to grow, driven by the increasing use of computing devices, the growth of the cloud, and the rise of artificial intelligence. The shift towards advanced memory technologies like DDR5, LPDDR5, and HBM will enable new applications and capabilities, further fueling demand.

China is expected to play an increasingly important role in the global memory market. The Chinese government is committed to developing a strong domestic semiconductor industry, and Chinese companies are making rapid progress in catching up with the leading memory manufacturers. As CXMT and other Chinese memory companies continue to innovate and expand their production capacity, they are likely to become major players in the global market.

However, the ongoing geopolitical tensions between the United States and China could create challenges for the industry. Trade restrictions and other barriers could hinder the flow of technology and investment, potentially slowing down the pace of innovation and growth.

The Future of Memory Technology

The future of memory technology is likely to be characterized by continued innovation and diversification. New memory technologies, such as 3D NAND flash memory and emerging memory technologies like resistive RAM (ReRAM) and magnetoresistive RAM (MRAM), are expected to play an increasingly important role in the market.

These new memory technologies offer several advantages over traditional DRAM, including higher density, lower power consumption, and faster speeds. They are well-suited for a variety of applications, including storage, embedded systems, and artificial intelligence.

The development of these new memory technologies is being driven by the growing demand for memory in a wide range of applications, including mobile devices, cloud computing, and artificial intelligence. As these applications become more demanding, the need for faster, more efficient, and more reliable memory will continue to grow.

The increasing complexity of memory technology is also driving the need for new approaches to memory management and optimization. Software-defined memory (SDM) is an emerging technology that allows for the dynamic allocation and management of memory resources, enabling greater flexibility and efficiency.

Conclusion

CXMT’s reported decision to halt DDR4 production and focus on advanced memory technologies reflects a strategic shift driven by both market forces and government policy. While it may lead to short-term supply challenges, it signals a longer-term ambition by China to become a competitive player in the high-end memory market. The move underscores the growing importance of memory technology in modern computing and the strategic implications of controlling its supply chain. The impact on consumers and businesses will depend on how quickly the industry can adapt to the changing landscape and how effectively Chinese companies like CXMT can execute their ambitious plans. The evolving geopolitical environment will also play a critical role in shaping the future of the memory market.

Frequently Asked Questions (FAQ)

-

Why is CXMT reportedly stopping DDR4 production?

CXMT is reportedly halting DDR4 production under the direction of the Chinese government to focus on developing more advanced memory technologies such as DDR5, LPDDR5, and potentially HBM. This move is aimed at catching up with international memory technology leaders, reducing reliance on older technologies, and enhancing China’s competitiveness in the global semiconductor market.

-

What are DDR5, LPDDR5, and HBM, and how do they differ from DDR4?

- DDR4: A widely used type of synchronous dynamic random-access memory (SDRAM) offering a high bandwidth interface.

- DDR5: The successor to DDR4, providing increased bandwidth, higher clock speeds, and improved power efficiency for high-performance PCs and servers.

- LPDDR5: A low-power version of DRAM designed for mobile devices, offering high bandwidth and low power consumption, making it ideal for smartphones and tablets.

- HBM (High Bandwidth Memory): A high-performance memory designed for high-end graphics cards and servers, featuring a wide memory bus and high bandwidth for applications requiring rapid processing of large datasets. HBM is vertically stacked, offering higher density and bandwidth.

-

What impact will this decision have on the global memory market?

In the short term, there may be potential supply shortages of DDR4 memory and increased prices, especially in the Chinese market. However, it could also accelerate the adoption of DDR5 and increase competition in advanced memory technologies, potentially leading to innovation and lower prices in the long term. Strategically, it highlights China’s determination to become a leader in the global semiconductor industry.

-

How does the Chinese government’s involvement affect this shift in production?

The Chinese government’s influence is significant. It is actively promoting the growth of the domestic semiconductor industry through funding, policy support, and strategic directives. The decision to shift away from DDR4 production appears to be a direct result of government guidance, aimed at accelerating the development of more advanced memory technologies and reducing reliance on foreign suppliers.

-

What are the challenges and opportunities for CXMT in focusing on advanced memory technologies?

Challenges:

- Developing expertise in advanced technologies like DDR5, LPDDR5, and HBM.

- Acquiring advanced manufacturing equipment and processes.

- Navigating the complex landscape of intellectual property rights.

- Gaining market acceptance for their products.

Opportunities:

- Backed by the Chinese government with necessary funding and support.

- Access to the large and growing Chinese market.

- Potential to gain market share due to geopolitical tensions between the U.S. and China.