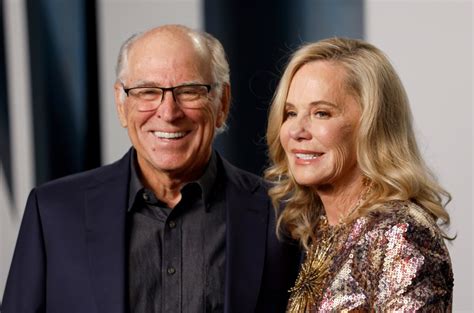

Jimmy Buffett’s widow, Jane Buffett, is reportedly embroiled in a complex estate dispute valued at $275 million, a situation she believes the late singer would have strongly disliked, according to sources close to the family. The estate complications involve various business entities, trusts, and the valuation of Buffett’s intangible assets, creating a challenging legal and financial landscape for the heirs.

The exact details of the dispute remain largely confidential, but reports indicate that Jane Buffett is upset and confused by the complexity and potential infighting arising from the estate’s management. Sources suggest she believes the drawn-out process and associated legal battles are contrary to Jimmy Buffett’s laid-back and uncomplicated approach to life. “He’d hate this!” an unnamed source close to the family told Yahoo News, reflecting Jane Buffett’s sentiments.

The estate includes not only traditional assets like real estate and financial investments, but also the significant intellectual property and branding rights associated with Jimmy Buffett’s musical legacy and the Margaritaville empire. Determining the fair value of these assets and distributing them appropriately among the heirs is proving to be a major hurdle. Experts in estate law and celebrity asset management suggest that such disputes are common when dealing with high-value estates, especially those involving substantial intellectual property.

The situation is further complicated by the various business interests and partnerships Buffett held, many of which require careful evaluation and restructuring to ensure a smooth transition. The estate’s executors are tasked with navigating these complexities while also honoring Buffett’s wishes and protecting the interests of his family.

While the specific parties involved in the potential disputes have not been publicly identified, it is understood that the primary beneficiaries include Jane Buffett and their three children: Savannah, Sarah (known as Delaney), and Cameron. The challenge lies in balancing the needs and expectations of each family member while adhering to the legal requirements and financial considerations of the estate.

The dispute highlights the importance of comprehensive estate planning, particularly for individuals with significant assets and complex business interests. Experts recommend that high-net-worth individuals work closely with experienced attorneys, financial advisors, and tax professionals to create a clear and enforceable estate plan that minimizes the potential for disputes and ensures a smooth transfer of assets to their heirs. The current situation underscores the emotional and financial toll that estate disputes can take on families, even when the deceased had the best intentions. The hope is that the Buffett family can resolve these issues amicably and in a manner that honors Jimmy Buffett’s legacy and wishes.

Background on Jimmy Buffett’s Estate and Career

Jimmy Buffett, who passed away on September 1, 2023, at the age of 76, left behind a vast musical and entrepreneurial empire. Best known for his laid-back “island escapism” music style, Buffett cultivated a dedicated following of “Parrotheads” and built a highly successful brand centered around the Margaritaville lifestyle.

His musical career spanned over five decades, producing numerous hit songs, including “Margaritaville,” “Come Monday,” and “Cheeseburger in Paradise.” Beyond his music, Buffett was a savvy businessman, expanding the Margaritaville brand into a wide range of ventures, including restaurants, resorts, casinos, and merchandise. This diversification contributed significantly to his substantial net worth.

The success of the Margaritaville brand stemmed from Buffett’s ability to tap into a desire for relaxation, escape, and a carefree lifestyle. He created a cultural phenomenon that resonated with millions of people, transforming his music into a multi-billion-dollar business. The Margaritaville empire’s value extends beyond its tangible assets, encompassing the brand’s strong emotional connection with its customers and its unique market positioning.

Buffett’s influence extended beyond the entertainment and hospitality industries. He was also a published author, writing both fiction and non-fiction books, many of which became bestsellers. His literary works often reflected his love of the sea, adventure, and the island lifestyle.

His impact on popular culture is undeniable, and his legacy continues to inspire musicians, entrepreneurs, and fans alike. The challenges surrounding his estate serve as a reminder of the complexities involved in managing and distributing substantial wealth, particularly when it includes significant intangible assets and diverse business interests.

The Complexity of Celebrity Estates

Celebrity estates, such as Jimmy Buffett’s, often present unique challenges compared to more conventional estates. The value of intangible assets, such as intellectual property rights, brand recognition, and future earnings potential, can be difficult to assess accurately. These assets require specialized expertise in valuation and management.

Another complicating factor is the potential for conflicts of interest among heirs and beneficiaries. Family members may have differing opinions on how the estate should be managed, leading to disputes over asset allocation, business operations, and the preservation of the deceased’s legacy. These conflicts can be exacerbated by the high stakes involved and the public scrutiny that often accompanies celebrity estate battles.

Estate planning for celebrities must address a wide range of legal and financial considerations, including tax planning, asset protection, and business succession planning. It is essential to have a comprehensive estate plan that clearly outlines the deceased’s wishes and provides a framework for resolving potential disputes. Without such a plan, the estate can become embroiled in costly and time-consuming litigation, depleting its value and causing significant emotional distress for the family.

The role of executors and trustees is also crucial in celebrity estates. These individuals are responsible for managing the estate’s assets, paying debts and taxes, and distributing the remaining assets to the beneficiaries. They must act in the best interests of the estate and its beneficiaries, which can be a challenging task when faced with complex legal and financial issues.

Potential Areas of Dispute

Several potential areas of dispute could arise in Jimmy Buffett’s estate:

-

Valuation of Intellectual Property: Determining the fair market value of Buffett’s music catalog, songwriting royalties, and the Margaritaville brand is a complex process. It requires expert analysis of historical earnings, future revenue projections, and market trends. Disagreements over the valuation of these assets could lead to disputes among the heirs.

-

Management of the Margaritaville Empire: The Margaritaville brand encompasses a wide range of businesses, including restaurants, resorts, and merchandise. Deciding how to manage these businesses going forward and who will have control over key decisions could be a source of conflict.

-

Distribution of Assets: Allocating the estate’s assets among the beneficiaries is another potential area of dispute. Family members may have different ideas about how the assets should be divided, particularly if there are specific bequests or trusts involved.

-

Tax Implications: The estate will be subject to federal and state estate taxes, which can be substantial. Minimizing the tax burden requires careful planning and execution. Disagreements over tax strategies could arise among the heirs.

-

Control of Jimmy Buffett’s Legacy: Preserving and protecting Buffett’s legacy is a paramount concern for his family. Disputes could arise over how his music and brand are used in the future, as well as how his personal story is told.

The Importance of Estate Planning

The situation surrounding Jimmy Buffett’s estate underscores the critical importance of comprehensive estate planning, regardless of an individual’s net worth. A well-crafted estate plan can help to:

- Minimize taxes: Estate planning strategies can help to reduce the amount of estate taxes owed, preserving more of the estate’s value for the beneficiaries.

- Avoid probate: Probate is the legal process of administering an estate, which can be time-consuming and costly. Estate planning tools, such as trusts, can help to avoid probate and streamline the transfer of assets.

- Protect assets: Estate planning can help to protect assets from creditors, lawsuits, and other potential threats.

- Ensure wishes are followed: A clear and comprehensive estate plan ensures that the deceased’s wishes are followed regarding the distribution of assets and the care of loved ones.

- Minimize family disputes: A well-thought-out estate plan can help to prevent family disputes by clearly outlining the deceased’s intentions and providing a framework for resolving potential conflicts.

Tools and Strategies for Effective Estate Planning

Several tools and strategies can be used to create an effective estate plan:

- Wills: A will is a legal document that specifies how an individual’s assets should be distributed after death.

- Trusts: A trust is a legal arrangement in which assets are held and managed by a trustee for the benefit of beneficiaries.

- Powers of Attorney: A power of attorney is a legal document that authorizes someone to act on another person’s behalf in financial and legal matters.

- Healthcare Directives: A healthcare directive, also known as a living will, is a legal document that specifies an individual’s wishes regarding medical treatment in the event that they are unable to make decisions for themselves.

- Life Insurance: Life insurance can provide financial security for loved ones after an individual’s death and can also be used to pay estate taxes.

- Gifting: Gifting assets during one’s lifetime can help to reduce the size of the estate and minimize estate taxes.

The Role of Legal and Financial Professionals

Creating an effective estate plan requires the expertise of legal and financial professionals. An experienced estate planning attorney can help to draft the necessary legal documents, such as wills, trusts, and powers of attorney. A financial advisor can help to assess an individual’s financial situation, develop strategies for minimizing taxes, and manage investments. A tax professional can provide guidance on tax-related matters and help to ensure compliance with applicable laws.

Working with a team of qualified professionals can help to ensure that an estate plan is comprehensive, effective, and tailored to an individual’s specific needs and circumstances.

The Path Forward for the Buffett Estate

The situation surrounding Jimmy Buffett’s estate is undoubtedly complex and challenging. However, with the guidance of experienced legal and financial professionals, the family can work to resolve the disputes, protect the estate’s value, and honor Buffett’s legacy.

The key will be open communication, a willingness to compromise, and a focus on preserving the family’s relationships. By working together, the heirs can navigate the complexities of the estate and ensure that Buffett’s wishes are ultimately fulfilled.

Expert Commentary

Estate planning attorney, Emily Carter, commented on the situation, stating, “Celebrity estates often involve unique assets and complex business interests, which can lead to disputes among heirs. It’s crucial to have a comprehensive estate plan that clearly outlines the deceased’s wishes and provides a framework for resolving potential conflicts.”

Financial advisor, David Miller, added, “Valuing intangible assets, such as intellectual property and brand recognition, is a significant challenge in celebrity estates. It requires specialized expertise and a thorough understanding of the market.”

The Emotional Toll of Estate Disputes

Beyond the financial and legal complexities, estate disputes can take a significant emotional toll on families. The loss of a loved one is already a difficult experience, and the added stress of a legal battle can exacerbate the grief and strain family relationships.

It is important for families to seek support from therapists or counselors during this challenging time. A neutral third party can help to facilitate communication, mediate disputes, and provide emotional support.

Lessons Learned

The situation surrounding Jimmy Buffett’s estate provides valuable lessons for individuals and families:

- Prioritize Estate Planning: Create a comprehensive estate plan that addresses all aspects of your financial and legal affairs.

- Seek Professional Guidance: Work with experienced legal, financial, and tax professionals to develop and implement your estate plan.

- Communicate Openly: Discuss your estate plan with your family members to ensure that they understand your wishes and are prepared for the future.

- Review and Update Regularly: Review your estate plan periodically and update it as needed to reflect changes in your circumstances.

- Focus on Family Relationships: Prioritize family relationships and strive to resolve disputes amicably.

FAQ: Jimmy Buffett Estate Dispute

Q1: What is the estimated value of Jimmy Buffett’s estate?

A1: The estimated value of Jimmy Buffett’s estate is $275 million, according to reports. This includes a combination of real estate, financial investments, intellectual property (including his music catalog and the Margaritaville brand), and various business interests.

Q2: Who are the primary beneficiaries of Jimmy Buffett’s estate?

A2: The primary beneficiaries of Jimmy Buffett’s estate are his widow, Jane Buffett, and their three children: Savannah, Sarah (Delaney), and Cameron.

Q3: What are the potential areas of dispute in the estate settlement?

A3: Potential areas of dispute include the valuation of intellectual property (music catalog and Margaritaville brand), management of the Margaritaville empire, distribution of assets among beneficiaries, tax implications, and control over Jimmy Buffett’s legacy.

Q4: Why are celebrity estates often more complicated than regular estates?

A4: Celebrity estates are often more complicated due to the presence of significant intangible assets such as intellectual property, brand recognition, and future earning potential, which are difficult to value accurately. Additionally, complex business interests, potential conflicts of interest among heirs, and high public scrutiny add to the complexity.

Q5: What can families do to minimize disputes during estate settlement?

A5: To minimize disputes, families should prioritize comprehensive estate planning with the help of experienced legal and financial professionals. Open communication among family members, a willingness to compromise, and a focus on preserving family relationships are also essential. Regularly reviewing and updating the estate plan to reflect changes in circumstances can also help prevent future conflicts.

The legal proceedings and estate management are expected to continue for several months, if not years, depending on the complexity and the potential for further disputes. The hope is that the family can navigate these challenges with grace and respect for Jimmy Buffett’s legacy, ensuring his contributions continue to resonate with his fans and the wider world for generations to come. The smooth management and transition of the Margaritaville brand will be a critical aspect of this process, preserving its value and continuing its appeal to its loyal customer base.