Delaying Social Security to maximize benefits while drawing down 401(k) funds early presents a complex retirement strategy, fraught with both potential rewards and significant risks, requiring careful consideration of individual circumstances and market conditions.

A growing number of retirees are contemplating a strategy that flips conventional wisdom on its head: tapping into their 401(k) or other retirement accounts early, sometimes even before age 60, while delaying Social Security benefits until age 70. This approach aims to maximize the guaranteed, inflation-adjusted income stream from Social Security, but financial advisors caution that it’s not a one-size-fits-all solution and carries substantial risks.

The primary appeal lies in the significant increase in Social Security benefits gained by waiting. For every year benefits are delayed past the full retirement age (FRA), which is currently 67 for those born in 1960 or later, individuals receive an 8% increase in their benefit amount, up until age 70. This means someone eligible for $2,000 per month at age 67 would receive $2,640 per month at age 70 – a substantial boost that lasts for the rest of their life and is adjusted annually for inflation. “Delaying Social Security can be a smart move, especially if you anticipate a long lifespan,” notes several financial advisors. “It’s essentially purchasing an annuity that’s guaranteed by the government and indexed to inflation.”

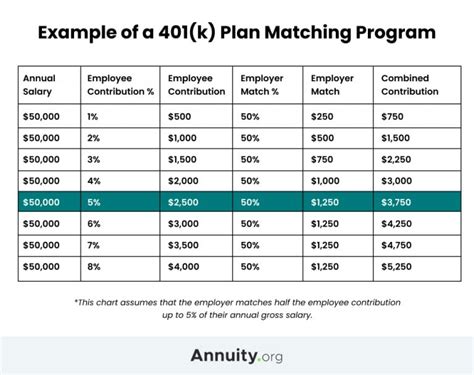

However, the strategy requires a readily available source of income to bridge the gap between early retirement and age 70. This is where the 401(k) comes in. Individuals draw down their 401(k) savings to cover living expenses, hoping that the market will perform well enough to sustain their withdrawals without depleting the account too quickly.

The risks are multifaceted. Market volatility is a significant concern. A major market downturn early in retirement could severely impact the 401(k) balance, forcing retirees to withdraw funds at a loss, further depleting their savings. Sequence of returns risk, the danger of experiencing poor investment returns early in retirement, is a key factor. “The sequence of returns matters a lot,” warns financial planner. “If you have a couple of bad years at the beginning, it can really derail your plan.”

Another crucial consideration is longevity. While delaying Social Security is advantageous for those who expect to live a long life, it might not be the best choice for individuals with health concerns or a family history of shorter lifespans. In such cases, claiming Social Security earlier might provide a greater lifetime benefit.

Taxes also play a significant role. Withdrawals from 401(k) accounts are taxed as ordinary income, potentially pushing retirees into higher tax brackets, especially if they are withdrawing large sums. Furthermore, the amount of Social Security benefits subject to taxation depends on a retiree’s combined income, which includes 401(k) withdrawals. Careful tax planning is essential to minimize the tax burden.

Moreover, healthcare costs, often unpredictable and substantial in retirement, can significantly impact the feasibility of this strategy. Unexpected medical expenses could force retirees to withdraw more from their 401(k) than planned, jeopardizing its long-term sustainability.

Inflation is another factor that must be carefully considered. While Social Security benefits are adjusted for inflation, withdrawals from a 401(k) are not. As the cost of living rises, retirees may need to withdraw more from their 401(k) to maintain their standard of living, potentially accelerating its depletion.

The decision to draw down a 401(k) early while delaying Social Security requires a comprehensive financial plan that takes into account individual circumstances, risk tolerance, life expectancy, tax implications, and potential healthcare costs. Consulting with a qualified financial advisor is crucial to assess the suitability of this strategy and develop a plan that aligns with individual goals and risk appetite.

For some, this approach can be a genius move, maximizing lifetime income and providing financial security in retirement. For others, it could be a risky gamble that leaves them vulnerable to market downturns and unforeseen expenses. The key is to understand the potential rewards and risks and to make an informed decision based on a thorough assessment of one’s financial situation.

In-Depth Analysis of the Strategy:

The strategy of drawing down a 401(k) early while delaying Social Security hinges on several key assumptions and requires careful planning to mitigate potential risks. Let’s delve deeper into the critical aspects:

-

Investment Returns: A fundamental assumption is that the 401(k) investments will generate sufficient returns to sustain withdrawals without depleting the account prematurely. This requires a well-diversified portfolio aligned with the retiree’s risk tolerance and time horizon. Conservative investments, while offering lower risk, may not generate the returns necessary to support withdrawals over an extended period. Conversely, aggressive investments, while offering the potential for higher returns, expose the portfolio to greater market volatility. A balanced approach is often recommended, but the specific asset allocation should be tailored to individual circumstances. Sophisticated modeling tools can help project potential investment returns under various market scenarios, providing a more realistic assessment of the strategy’s feasibility.

-

Withdrawal Rate: Determining a sustainable withdrawal rate is crucial to prevent depleting the 401(k) too quickly. A common guideline is the “4% rule,” which suggests withdrawing 4% of the portfolio’s initial value in the first year of retirement and then adjusting the withdrawal amount annually for inflation. However, the 4% rule is not a guarantee of success and may not be appropriate for all retirees, especially those with longer life expectancies or higher spending needs. A more conservative withdrawal rate may be necessary to ensure the 401(k) lasts throughout retirement. Financial advisors can help calculate a sustainable withdrawal rate based on individual circumstances and market conditions.

-

Longevity: Life expectancy is a critical factor in determining the optimal Social Security claiming strategy. Delaying Social Security is generally advantageous for those who expect to live a long life, as it maximizes their lifetime benefits. However, for individuals with health concerns or a family history of shorter lifespans, claiming Social Security earlier may be a better option. Actuarial tables and online calculators can help estimate life expectancy, but it’s important to remember that these are just averages and individual circumstances can vary significantly.

-

Tax Planning: Tax planning is an essential component of this strategy. Withdrawals from 401(k) accounts are taxed as ordinary income, potentially pushing retirees into higher tax brackets. Strategies to minimize taxes include Roth conversions, which involve converting traditional 401(k) assets to Roth IRAs, where withdrawals are tax-free in retirement. However, Roth conversions can trigger a tax liability in the year of the conversion, so it’s important to carefully consider the tax implications. Another strategy is to manage the timing of withdrawals to avoid exceeding certain income thresholds that could trigger higher tax rates.

-

Healthcare Costs: Healthcare costs are a major concern for retirees, and unexpected medical expenses can significantly impact the feasibility of this strategy. It’s important to factor in potential healthcare costs when developing a retirement plan. This includes Medicare premiums, supplemental insurance, and out-of-pocket expenses. Long-term care insurance can help protect against the high costs of nursing home care or home healthcare.

-

Unexpected Expenses: Life is unpredictable, and unexpected expenses can arise in retirement. It’s important to have a contingency fund to cover unexpected costs, such as home repairs, car repairs, or family emergencies. This can help avoid depleting the 401(k) prematurely.

Alternative Strategies and Considerations:

While the strategy of drawing down a 401(k) early while delaying Social Security can be appealing, it’s not the only option. Other strategies to consider include:

-

Working Part-Time: Working part-time in retirement can provide additional income to supplement Social Security and 401(k) withdrawals. This can help reduce the amount of money needed to be withdrawn from the 401(k), extending its lifespan.

-

Downsizing: Downsizing to a smaller home can free up equity that can be used to fund retirement expenses. This can also reduce property taxes and other housing-related costs.

-

Relocating: Relocating to a lower-cost area can reduce living expenses, making it easier to manage retirement finances.

-

Annuities: Purchasing an annuity can provide a guaranteed stream of income in retirement. Annuities can be either immediate or deferred, and they can be either fixed or variable. Fixed annuities offer a guaranteed rate of return, while variable annuities offer the potential for higher returns but also carry more risk.

Ethical Considerations for Financial Advisors:

Financial advisors have a fiduciary duty to act in their clients’ best interests. When advising clients on whether to draw down a 401(k) early while delaying Social Security, advisors must carefully consider the client’s individual circumstances, risk tolerance, and financial goals. They must also disclose all potential risks and conflicts of interest.

It’s unethical for advisors to recommend this strategy solely to generate fees or commissions. Advisors should provide objective advice and help clients make informed decisions that are in their best interests. Transparency and full disclosure are essential.

The Role of Government Policy:

Government policies can have a significant impact on retirement planning. Changes to Social Security benefits, tax laws, and healthcare regulations can all affect the feasibility of this strategy. For example, proposals to raise the Social Security retirement age or reduce benefits could make delaying Social Security less attractive. Conversely, tax incentives for retirement savings could make it easier to accumulate sufficient savings to bridge the gap between early retirement and age 70.

Policymakers should carefully consider the impact of their decisions on retirees’ financial security. They should also promote financial literacy and provide resources to help individuals make informed decisions about retirement planning.

Psychological Considerations:

Retirement is a significant life transition, and it’s important to consider the psychological aspects of this strategy. Some retirees may find it difficult to adjust to the idea of spending down their savings, even if it’s part of a well-thought-out plan. Others may worry about running out of money, especially if they experience unexpected expenses or market downturns.

It’s important to have a positive mindset and to focus on the benefits of this strategy, such as maximizing Social Security income and enjoying a more flexible retirement lifestyle. Support from family, friends, and a financial advisor can also help ease the transition.

Case Studies:

To illustrate the potential benefits and risks of this strategy, let’s consider two hypothetical case studies:

-

Case Study 1: The Successful Scenario

- Individual: John, age 62, retired from a successful career with a 401(k) balance of $1 million. He is eligible for $2,000 per month in Social Security benefits at age 67.

- Strategy: John decides to draw down his 401(k) at a rate of 4% per year ($40,000) while delaying Social Security until age 70. He invests his 401(k) in a diversified portfolio that generates an average annual return of 7%.

- Outcome: John’s 401(k) provides sufficient income to cover his living expenses until age 70. At age 70, he begins receiving $2,640 per month in Social Security benefits, which are adjusted annually for inflation. His 401(k) continues to grow, providing him with a comfortable retirement.

-

Case Study 2: The Risky Scenario

- Individual: Mary, age 60, retired with a 401(k) balance of $500,000. She is eligible for $1,500 per month in Social Security benefits at age 67.

- Strategy: Mary decides to draw down her 401(k) at a rate of 5% per year ($25,000) while delaying Social Security until age 70. She invests her 401(k) in a portfolio that is heavily weighted in stocks.

- Outcome: Mary experiences a major market downturn in the first few years of retirement. Her 401(k) balance declines significantly, and she is forced to withdraw funds at a loss. By age 70, her 401(k) is significantly depleted, and she is relying primarily on her Social Security benefits, which are not enough to cover her living expenses.

These case studies highlight the importance of careful planning and risk management. The successful scenario demonstrates how this strategy can work when market conditions are favorable and withdrawals are sustainable. The risky scenario illustrates the potential consequences of market downturns and excessive withdrawals.

Conclusion:

The decision to draw down a 401(k) early while delaying Social Security is a complex one that requires careful consideration of individual circumstances, risk tolerance, and financial goals. It’s not a one-size-fits-all solution and carries both potential rewards and significant risks.

Before pursuing this strategy, it’s essential to develop a comprehensive financial plan that takes into account investment returns, withdrawal rates, longevity, tax implications, healthcare costs, and unexpected expenses. Consulting with a qualified financial advisor is crucial to assess the suitability of this strategy and develop a plan that aligns with individual goals and risk appetite.

While this approach can be a genius move for some, maximizing lifetime income and providing financial security in retirement, it could be a risky gamble for others, leaving them vulnerable to market downturns and unforeseen expenses. The key is to understand the potential rewards and risks and to make an informed decision based on a thorough assessment of one’s financial situation. Only then can one determine whether this unconventional retirement strategy is truly a stroke of genius or a dangerous gamble.

Frequently Asked Questions (FAQ):

-

What are the main benefits of delaying Social Security? Delaying Social Security increases your monthly benefit amount. For each year you delay past your full retirement age (FRA), your benefit increases by 8% up to age 70. This results in a significantly higher monthly payment that is also adjusted annually for inflation, providing a guaranteed income stream for life. “Delaying Social Security can be a smart move, especially if you anticipate a long lifespan,” according to advisors.

-

What are the primary risks of drawing down my 401(k) early? The main risks include market volatility (a market downturn could deplete your savings), sequence of returns risk (poor investment returns early in retirement), potential tax implications (withdrawals are taxed as ordinary income), longevity risk (outliving your savings), and unexpected healthcare costs. “The sequence of returns matters a lot,” warns a financial planner, noting the impact of bad years early on.

-

How does sequence of returns risk affect this strategy? Sequence of returns risk refers to the danger of experiencing poor investment returns early in retirement. If your 401(k) performs poorly in the first few years, you may be forced to withdraw funds at a loss, which can significantly deplete your savings and make it harder to recover.

-

What factors should I consider before deciding to draw down my 401(k) early and delay Social Security? Consider your life expectancy, risk tolerance, financial needs, tax situation, potential healthcare costs, and market conditions. It’s crucial to create a comprehensive financial plan and consult with a qualified financial advisor to assess the suitability of this strategy for your individual circumstances.

-

Is the “4% rule” a safe withdrawal rate for this strategy? The “4% rule” suggests withdrawing 4% of your initial 401(k) balance in the first year of retirement and then adjusting the withdrawal amount annually for inflation. While it’s a common guideline, it may not be appropriate for everyone. Factors such as longer life expectancies, higher spending needs, and unfavorable market conditions may necessitate a more conservative withdrawal rate. It’s important to assess your individual circumstances and consult with a financial advisor to determine a sustainable withdrawal rate.